Vietnam has become a magnet for foreign investment in recent years, with record capital inflows in 2023. The surge is driven by a number of factors, including its strategic location of the country, its young and growing workforce, and its improving business environment. Let’s go through Foreign investment in Vietnam – How and How much

In this article, we will briefly go through the steps to:

- Some key business lines and capital contribution ratio for each

- Investment capital

- Establish a foreign business in Vietnam

- Some notes for businesses before and after establishing a company

In details:

1. SOME KEY BUSINESS LINES AND CAPITAL CONTRIBUTION RATIO FOR EACH

1.1 Fully owned (100% foreign capital):

Manufacture:

- Garment, textile, footwear

- Electronics, machinery

- Food Processing

Information technology (IT):

- Software Development

- IT consulting

- Data processing

Wholesale and retail:

- Most industries, except for a limited number of sectors such as pharmaceuticals, telecommunications

Travel and hotel:

- Hotels, resorts

- Travelers

- Travel services

Education:

- Establishment of private schools

- Training

Medical:

- Hospitals, private clinics

1.2 Partial ownership (Joint venture with Vietnamese partner):

Banking and Finance:

- Ownership limit 20%

- Can be higher through joint venture with state bank

Insurance:

- Ownership limit 49%

- 35% for life insurance

Telecommunication:

- Ownership limit 49%

- Specific conditions depend on the type of service

Transportation:

- Air transport: 49%

- Sea transport: 70%

Retail:

- Pharmaceuticals, telecommunications: 51%

Note 1: Some industries require legal capital (Minimum capital required to establish a business, including:

– Real estate business, must have a minimum of 15% and 20% capital for projects with an area of less than 20 hectares and over 20 hectares, respectively.

– Insurance business, capital from 4 billion to 600 billion VND

– Gold business, capital from 1 billion to 5 billion VND depending on province and city

Note 2: Investment capital will affect license tax

2. INVESTMENT CAPITAL

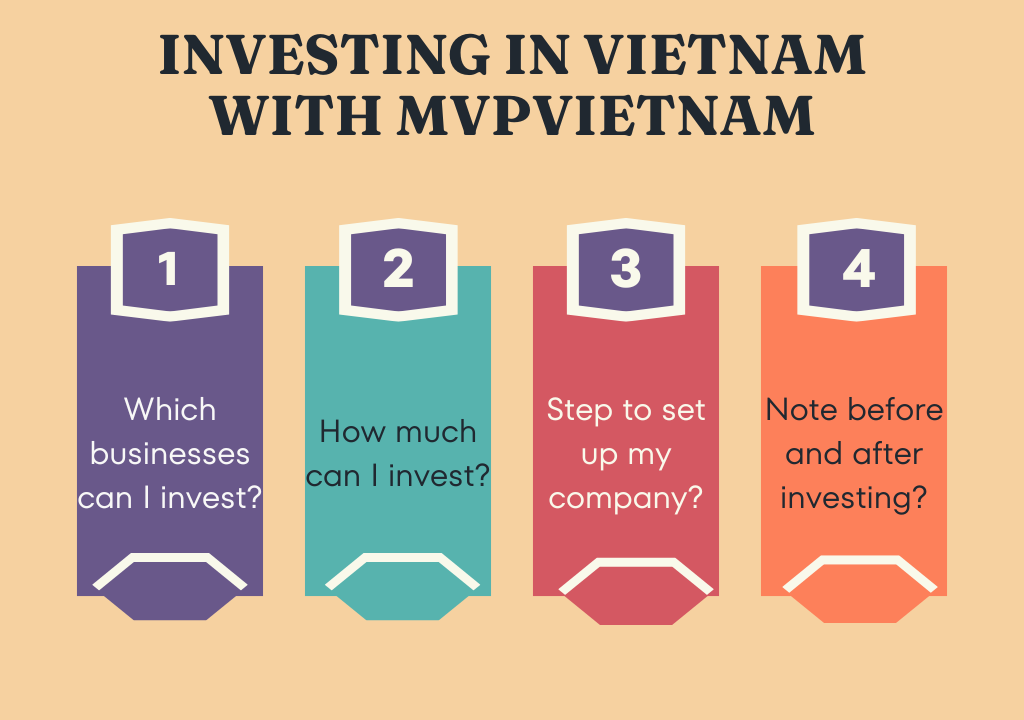

Vietnam attracted around 36.6 billion U.S. dollars in foreign investment in 2023, a rise of 32.1 percent year on year, the General Statistics Office has reported.

Minimum investment capital is one of the questions MVPVietnam frequently receives from foreign individuals intending to establish businesses in Vietnam.

- Vietnam does not require minimum capital to register a business for most industries, however, depending on the industry, especially for foreign-invested enterprises, the level of registered investment capital should be close to the actual initial investment capital. This is to demonstrate the feasibility of the project and increase the likelihood of the project being approved.

- The amount of investment capital of a foreign investor must be the amount of capital transferred from abroad to Vietnam, or the amount of legal capital that the investor has done business or worked in the country.

- Investment capital must be transferred to the company’s capital account within 90 days after granting a business license

- Investors’ capital contributions to FDI companies must be made by bank transfer

3. ESTABLISH A FOREIGN BUSINESS IN VIETNAM

3.1 Pre-investment stage:

- Secure a Business Location: Find a suitable location for your company’s operations and secure a lease agreement.

- Choose a Business Structure: Decide on the type of foreign-invested enterprise (FIE) you want to establish, such as a limited liability company or a joint-stock company.

- Research Industry Regulations: Investigate any specific regulations or licensing requirements that may apply to your chosen industry.

3.2 Company Registration:

- Apply for an Investment Certificate: This is the first and most crucial step. You’ll need to submit a detailed application package outlining your investment project to the relevant authorities.

- Company Registration Certificate: Once the Investment Certificate is granted, proceed with registering your company to obtain a Business Registration Certificate.

- Business License: If your company plans to engage in retail sales or establish a retail outlet, you’ll need to apply for a separate Business License.

3.3 Post-Registration:

- Open Company Bank Accounts: Establish bank accounts for your company to manage its finances.

- Comply with Post-Registration Requirements: This may involve registering for taxes, obtaining work permits for foreign employees, and fulfilling other ongoing compliance obligations.

- Apply for Additional Licenses/Permits (if required): Depending on your industry, you might need to acquire additional licenses or permits to operate legally.

4.SOME NOTES FOR BUSINESSES BEFORE AND AFTER ESTABLISHING A COMPANY

4.1 Before establishing

- The office, factory, and headquarters address must be legal and have complete documents proving the location of investment registration:

- House and office rental contract

- Red book notarized copy of the homeowner (with assets attached to the land)

- Charter capital must be proven through bank account statements

- To carry out procedures for applying for an investment visa, work permit, and investor’s passport should be valid for more than 6 months.

- For some specific industries, investors must have documents proving their capacity and experience.

4.2 After establishing

- Buy electronic digital signatures to make digital tax payments

- Open a business bank account and notify the bank account with the City Department of Planning and Investment

- Contribute investment capital through a bank account within 90 days from the date of issuance of the investment license

- Submit license tax declaration and pay license tax

- Making company signs and company seals

- Initial tax declaration

- Register to issue electronic invoices

- Submit reports on project activities and labor usage to relevant departments on a quarterly and annual basis.

- Annual audit

With careful planning and adherence to regulations, your foreign-owned business can thrive in this dynamic economy.

This article serves as your guide to answer the basic questions of the process. With our deep understanding of the Vietnamese business landscape, we’ll help you navigate cultural nuances and build a strong foundation for success.

Contact MVPVIETNAM today to unlock your company’s full potential in Vietnam.